Earlier this year I interviewed a panel of commercial awareness experts (which included the winners of the Aspiring Solicitors’ Commercial Awareness competition). One thing that kept coming up was Finimize– a company that creates easy-to-read content on business and finance news, and emails it to you every day. Emojis and pictures included. I hadn’t heard of Finimize before then, but I have to admit I am now a convert.

Anyway, because I’m one of those people who likes to find out how things are done, I interviewed Carl Hazeley, the VP of content at Finimize. He’s responsible for making sure everything published is jargon free and crafted in the “Finimize voice” (because apparently that’s a thing). And, spoiler alert, he has some really great tips for getting your head around business news.

Hi Carl. Thanks for chatting to me today.

When you’re looking at a topic, maybe a market you’re not that familiar with, how do you get your head around it? Sort of, get an overview of it? Do you have any techniques?

I’ve got cheat codes for figuring out a market pretty quick. My background is that I was an Equity Research Analyst for Goldman Sachs. I started by researching mid-cap stocks, so everything from Greggs the bakers to the company that makes the ATM machines in Barclays. I then moved onto internet companies, so mostly looking at start-ups. And what I learned is that pretty much all industries in the world work in the same way. There are always several things that drive growth, but there are probably two or three really important things. And on any given day, in any news item, there will probably be one thing that’s particularly important. And there’s also a similar dynamic to profitability. So for every company in the world it’s probably the same two or three things that impact how profitable they are going to be. While there are a few random things that pop up for specific companies, mostly it’s kind of formulaic.

What sort of 2 or 3 things do you mean?

Well, businesses grow either because they are selling more stuff, or they are selling the same stuff for higher prices. And you can dig deeper and think, are they selling more stuff because they are making more stuff that people want? Adding new products, going into new markets, finding new customers. Or are they spending money on advertising? Or is it a business that grows when the overall economy grows? For example, if the economy is doing well people are building more houses so the brick companies are doing well.

So when you’re looking at a company, you’re looking to see what are the 2 or 3 things that are effecting it.

And then you’re trying to see how those things have changed recently?

Exactly. Once you’ve gotten that sort of cynical approach to figuring out what’s going on, you can use the same technique for looking at profitability. Why do profits go up? Either prices go up, or costs come down. That is pretty much it. It’s just about figuring out which of those is happening and why. Then you can plug it back into the market. Say, ok, now I have a very basic understanding of what’s going on, let’s see what investors are thinking about it. How are they reacting to those things? And that helps you sort of piece it together.

Finimize does a great email newsletter, and what I really like about it is that it is split into segments: What’s going on here? What does it mean? Why do I care?

Are those the questions you’re asking yourself when you’re researching stories?

Taking it out of finance- if someone in the world tells you anything, if there’s any news, those are the questions that people ask. What’s happening? Maybe a bomb hit the Middle East. What does that mean? Well, people have died. Why should I care? Because you might get bombed. It’s an important structure for any sort of news.

What I’ve noticed is that most media outlets, especially in finance, take the ‘why should I care’ as a given. Because they are so specialist and technical, you wouldn’t be reading it if you didn’t already care. However, for our audience, the answer is not quite as obvious. Especially for our readers in finance adjacent sectors, like law. The short answer is you care because other people care. But that’s a bit shit.

Here’s a helpful analogy I used to use while recruiting at Goldman. Imagine there are two TVs on the wall. I say to you, always pick the left TV and you’ll make 10% a year. And you can do that and you’ll probably be pretty happy. However, if you don’t understand why you’re picking that tv at some point something might change, and it might be the right time to pick the other tv, but you won’t know. So you need to know why you should care.

Taking WPP as an example- the next time they report, it probably won’t be as important. But if you only care because I’ve told you to care, you’ll think that it’s always important when WPP report….but it’s not.

I think the ‘why do I care’ question is really important for law students. It’s easy to reel off a story about a market or a client, but it takes another level of knowledge to be able to explain to a Partner what it means for the firm.

But there is so much information out there. How do you boil down what is relevant and what’s not? Because you and the team must be able to do that at speed to create so much content every day.

There are three questions I try to answer with story selection. Firstly, is this one of the biggest stories of the day? We have a global, a US and EU edition. Sometimes the stars align and the biggest two stories of the day are the biggest all over the world.

And you get to go home at 3pm?

Exactly…well…not quite that early! However, other times there will be a huge amount of stuff happening in the US, but frankly no one outside the US cares about it. And there will be stuff that Europeans really care about but Americans don’t.

The second question is, what is the point to the story? Sometimes the biggest story of the day is something we’ve already written about. There’s nothing new to say. There’s no point.

And the final question is; is there something teachable? Sometimes a company reports a result which is…sort of ok. Not a huge deal. But what is really interesting is the mechanics of how the business works. For example, the watch maker Swatch has really high fixed costs (i.e. their salaries and machinery). They’re stuck with these- they can’t just get rid of them. But this means that when sales go up, their cost-base stays the same. So it’s pretty much just all profit. It’s interesting to compare that to other companies who have to hire more people and buy more machinery when sales go up, as they might not make any profit (or even lose money).

Is there anything that you do to make sure you’re still keeping in touch with markets even if you’ve not written about them recently? I’m interested in any good habits you have.

So I guess I’m generally always watching markets, just out of habit. I look online, but I also like the Bloomberg app which pushes the big headlines. That, and the FT’s whatsapp group. Oh, and Finimize- obviously. Outside of all that, I’ve got a network of friends -probably geekier than most- who talk about the markets. When a big story breaks out from the FT into BBC news they’re like ‘ohh what’s going on?’ Last month one of my friends messaged me saying, ‘Pepsi just bought Sodastream- isn’t that crazy?’ And I was like ‘…I guess you didn’t read my email this morning.’

A good rule of thumb is that if people with no skin in the game are talking about it, it’s probably worth knowing about.

Do you have any advice for people who are just starting to develop their commercial awareness and become financially savvy? Finimize is great at making complex stuff simple, but is there anything you can do alongside?

Before going into banking my undergrad was genetics, and I thought I wanted to be a doctor, so I had literally no commercial awareness at all. However, between December and March I learned everything…well not everything…but a ton of finance stuff to try and get into Goldman Sachs. So I was reading Bloomberg every day, the FT every day, which is pretty daunting and jargon filled. It’s hard. So my advice is that you should try reading finance opinion pieces rather than hard news. Because those tend to be a bit more conversational, chattier, less jargon heavy. And for your audience, who want to do well in interviews, reads the Lex column. It shortcuts some of the thinking but gives you some of the rationale. It allows you to speak confidently about finance because you are pretty sure it’s correct. And once you’ve got that confidence – you think ‘yeah, I get this now, I understand it.’ And from there you can build on that knowledge and form your own opinions.

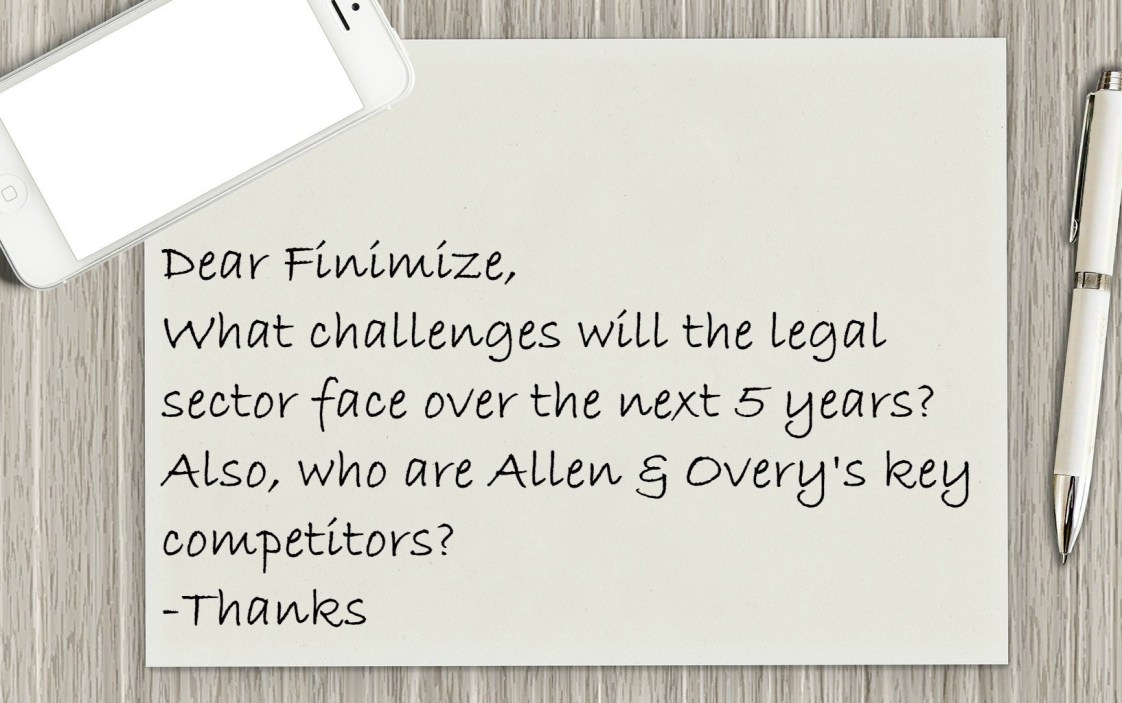

At the bottom of the Finimize emails there is usually a question sent in by a reader. Do you ever look at these questions and think, ‘oh crap, I have no idea!’?

On the whole, we receive 3 types of questions. The ones where I’m like ‘yep, good question, fair question, happy to answer it.’ The ones where people are clearly asking me to write their undergrad essay for them. And the others where I’m like, shit I don’t have a clue.

However, most economies and industries work in the same way. So if you can get a handle on the two or three biggest things driving the relevant economy or industry, you can usually piece together an answer. It’s not necessarily going to be all singing all dancing. But the questioner, if they’re asking the question, generally has even less of a starting point. So I approach answering those questions like, ‘here’s my best go, but I want to know more so let’s chat about it.’

That is a pretty solid technique for interviews, especially when you have Partners asking you questions that they already know the answers to.

So just to finish up, do you have any parting comments- about finance in general or Finimize?

One thing just to think about, which is slightly broader than commercial awareness, is the goal of Finimize. Financially, our generation isn’t doing too bad – and as a group, we’ve got a huge opportunity. The problem is the stuff we have invested in is basically crap, or at least far too conservative. ISAs are offering basically no interest, and at this rate, we’re all going to run out of money before we die.

So what Finimize is trying to do is to build a suite of products that give people the tools and confidence to take their money into their own hands and do something with it. To become their own financial advisors. And personally, I’m apathetic as to whether you actually invest in stuff or not. You can read Finimize, learn about investing, and then decide that you don’t want to do anything. That’s fine. But what I don’t want to happen is that you look at all of these things and think ‘I know I should be doing something but it’s just so complicated, scary and jargon filled that I can’t face it.’ If you choose to do nothing- fine by me.

Just don’t do nothing out of fear.

That is a good parting message! Thank you so much Carl- I really appreciate you taking the time to answer my questions.

If you enjoyed that read and fancy more hints and tips, here’s another article you might like: Commercial Awareness: An Interview With The Experts.

And as personal finance is a thing I geek out over (I get genuinely excited about compound interest), I thought I’d take this opportunity to share with you some other stuff I love.

The Naked Trader: How Anyone Can Make Money Trading Shares by Robbie Burns (no, not the Robbie Burns). While this investment strategy doesn’t work for me, I thoroughly enjoyed reading this book- it’s simple, funny and you’ll definitely learn a thing or two.

How a Second Grader Beats Wall Street: Golden Rules Any Investor Can Learn by John Wiley & Sons. This is perhaps my all-time favourite investment book. It’s more in-depth than the others, and it’s fair to say it’s not a book for absolute beginners. But the structure is unique and interesting, and I think the logic is pretty sound.

Operation Enough!: How to Retire Remarkably Early is a book written by Anita Dhake. She was a commercial solicitor in the US before retiring absurdly early in her 30s. If you like the conversational down-to-earth style of my blog, you’ll love this book.